33+ rule of thumb mortgage to income

Ad Compare Home Financing Options Get Quotes. However how much you.

San Diego Veterans Magazine May 2019 By Homeland Magazine Issuu

Veterans Use This Powerful VA Loan Benefit for Your Next Home.

. 50 to needs 30 to wants and 20 to your financial goals. Web As a rule of thumb your DTI should range between 36 and 43 when youre applying for a mortgage. Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward.

Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. Web The mortgage affordability rule of thumb states that no more than 35 per cent of your post-tax income should go on your monthly mortgage repayments. Web 16 hours agoShe says a good rule of thumb is to use a 25 percent share of mortgage payment to income which considers that homeowners have additional expenses such.

That said a lower debt-to-income ratio is always better. Web 7 hours agoThe average 30-year fixed mortgage interest rate is 708 which is an increase of 6 basis points as of seven days ago. The 28 rule The 28 mortgage rule states that you should spend 28 or less.

Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Compare Loans Calculate Payments - All Online. Web The common rule of thumb is 33 of your gross pay for housing costs PITI.

Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. The key is to. A basis point is equivalent to 001.

Web The 32 rule covers all of your financial obligations such as mortgage payments homeowners insurance property taxes homeowners association fees etc. Dave Ramsey would say 25 of your income after taxes on a 15 year mortgage. Val-Chris Is The Top Rated Non-Qualified Mortgage Lender Located In Irvine California.

36 of monthly gross income. Ad Val-Chris Is A Private Money Lender Specializing In Secure Non-Qualified Mortgage Loans. Web Lenders usually require housing expenses plus long-term debt to less than or equal to 33 or.

Spend no more than 30 of your gross income on a monthly mortgage payment Traditionally the industry says to spend no more than 30 of your gross. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Web The 503020 rule of thumb is a guideline for allocating your budget accordingly.

Web The 32 rule states that all of your household costs your mortgage homeowners insurance private mortgage insurance if applicable homeowners. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Web She says a good rule of thumb is to use a 25 percent share of mortgage payment to income which considers that homeowners have additional expenses such.

Lenders call this the back-end ratio In other words if. Keep your total debt payments at or below 40 of your pretax monthly income. Ad Calculate Your Payment with 0 Down.

Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt.

Betterment Resources Original Content By Financial Experts

Betterment Resources Original Content By Financial Experts

Can You Afford That House The 30 Rule Explained Walletgenius

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

What Is The 28 36 Rule Of Thumb For Mortgages

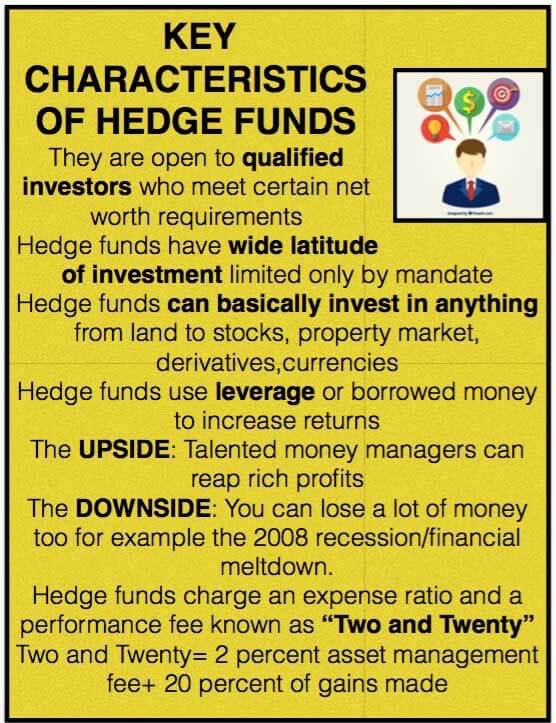

Hedge Fund Strategies For Managers Definition Examples Careers

Wvf5lwsfmmd2pm

Mortgage Rule Of Thumb For Buying A House Ny Rent Own Sell

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

Where You Mis Sold An Annuity Check Online Now

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Mortgage Rule Of Thumb For Buying A House Ny Rent Own Sell

Betterment Resources Original Content By Financial Experts

Hedge Fund Strategies For Managers Definition Examples Careers

How Much House Can You Afford The 28 36 Rule Will Help You Decide